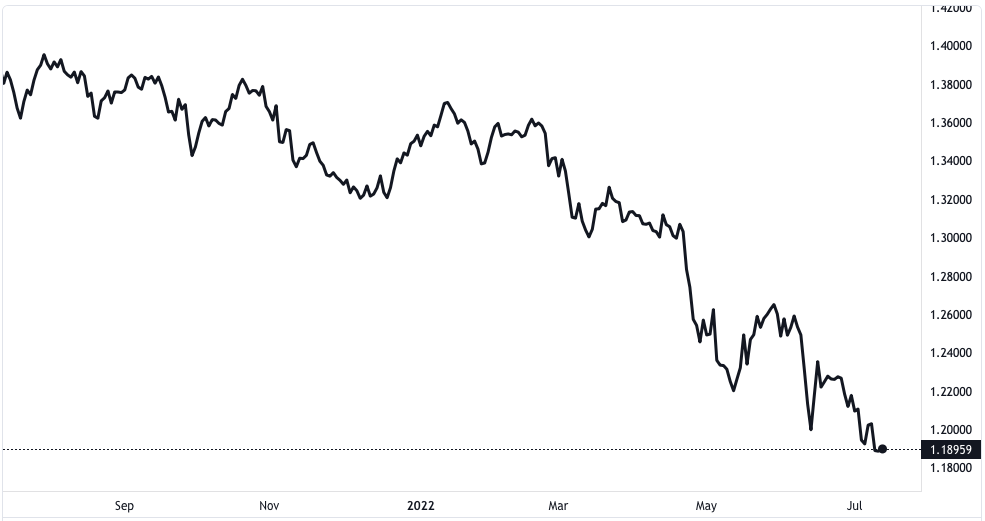

The GBP/USD pair pulled back to 1.1900 as there is more anxiety in the market. This comes before the publication of major reports in the UK and the US. Much more, the pair broke a downtrend going for two days while above a 2-year low.

The Positive Market Sentiments

The latest break came as the market headed into the London open on Wednesday. A relatively positive market mood underpinned the Dollar’s drawback and aided the pair. The GBP/USD pair thus consolidated losses near many months’ low in the early Asian session.

The reason behind the relatively positive mood might be attributed to the heightened White House comments. The eased data from the US might also be of a certain effect.

GBP/USD price chart. Source TradingView

Reuters reported that the economic data in the US was not consistent with the recession. The first and second quarters’ recession was supposed to generate a different result. The jobs report in June also has the same inconsistencies.

The Reuters report added to the market’s gain booking arrangement as the key events came up. Furthermore, the NFIB Optimism index for the month of June dropped to its lowest. It hasn’t been so low since early 2013 as it shadows 89.5 against 93.1 initially.

The Financial Times has said it is a lack of strategies that affect the UK economy. The UK requires a clear long-term strategy that aids a high growth in national production. The current state is a result of inconsistency from ministers over the years.

The news cited the Treasury Select Committee and National Audit Office as giving data for the conclusion. It also mentioned the Resolution Foundation as well.

The Ghost of a Past PM

Former Chancellor of the UK, Rishi Sunak, seems to tow the path of Margaret Thatcher. His economic policies might be similar to that of the former PM if he wins. He told the media that there will be tax cuts but fighting inflation is key.

In the midst of all these, the US Dollar index is struggling around a twenty-year high. The S&P 500 and the ten-year US Treasury bonds broke a two-day decline. Stock markets in the Asia-Pacific equally seem to diminish the initial bearish trend.

Going ahead, the expected recovery in the UK GDP for May was 0.0% against -0.3%. This might join the possible improvement of the month-on-month reading of the MPI. It would then be in favor of the GBP/USD bulls.

But if there is any disappointment in the reports, sellers might capitulate. After that, the US CPI for June is expected to increase to 8.8% year on year. It will be rising from the initial 8.6% and the pair traders will be watching.